With the rapid development of fintech, lending is no longer limited to traditional banks. Virtual loan agencies have risen rapidly in recent years, providing more and more diverse options for those in need of funds. However, is it better for you to choose a traditional bank loan or a virtual loan?

This article will help you make smarter lending decisions based on your needs by comparing the pros and cons of the two.

Traditional Bank Loans It is a loan service provided by financial institutions such as banks, which usually includes personal loans, home loans, and business loans. These loan services often require a face-to-face application process and are accompanied by more documentation requirements.

1. Trustworthy

Traditional banks often have a long history and good reputation, providing borrowers with a greater sense of security.

2. Interest rates are usually lower

Interest rates on bank loans are often more attractive than virtual loans, especially for borrowers with good credit records.

3. More product selection

Traditional banks offer a variety of loan products, such as long-term loans, home mortgages, and business loans, to meet different needs.

4. Professional Consultancy Services

Borrowers can communicate face-to-face with professional loan advisors at the bank for targeted advice.

1. The application process is tedious

Bank loans usually require more documents, such as proof of income, tax statements, and credit reports, and longer application times.

2. Longer approval time

From submitting an application to obtaining funds, it can take days or even weeks, and may not be flexible enough for borrowers who need funds urgently.

3. Stricter eligibility requirements

Banks may reject applicants with lower credit scores, such as higher credit score and income stability requirements for borrowers.

A loan service offered by an online lending platform or a fintech company, borrowers can complete applications, approvals, and fund disbursements through an online process. These platforms often attract borrowers with streamlined processes and flexible conditions.

1. Easy and quick application

Borrowers simply submit applications online via mobile phone or computer, and the whole process is generally in done within 15 minutes

2. Fast Approval

Virtual loans typically use automated systems for approval, and many platforms are in Within 24 hoursFinished fund issuance is perfect for users who need funds in urgent need.

3. Flexible Eligibility Requirements

Virtual loans are less demanding on credit scores and proof of income and are particularly friendly to freelancers or small business owners.

4. Transparent fee structure

Online lending platforms often provide clear details of fees and interest rates, so borrowers can easily compare the terms of different platforms.

1. Interest rates may be higher

Because virtual loans have lower eligibility requirements for borrowers, interest rates are usually higher than traditional banks, especially for borrowers with lower credit scores.

2. Potential trust issues

The reputation of some emerging virtual loan platforms has not yet been established, and borrowers need to choose carefully to avoid falling into loan scams.

3. Lack of face-to-face services

Virtual loans usually do not have physical branches and cannot provide face-to-face consultation services similar to banks.

Depending on your needs and circumstances, you can refer to the following recommendations:

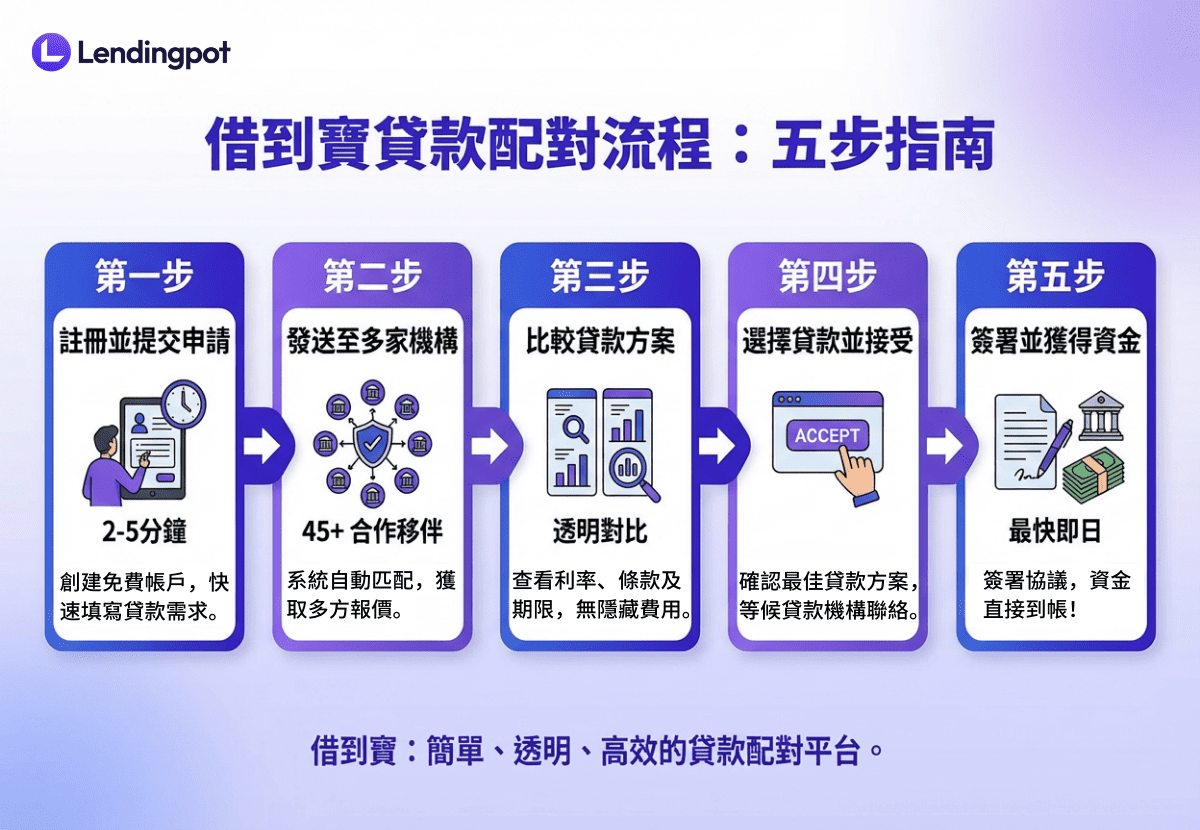

Whether you choose traditional bank loans or virtual loans, Lendingpot can help you find the right loan plan faster and easier. We collaborate with Hong Kong 45+ Home Licensed Loan Agencies to provide transparent and fair loan comparison services

Of course you can! Lendingpot offers a one-stop loan comparison service that allows you to find the best loan plan based on interest rates, terms and approval time.

No need, Lendingpot is completely free for users. We charge service fees from our partner loan agencies so you can apply for a loan with confidence.

Suitable for! Our platform supports freelancers and small business owners, especially users who find it difficult to pass bank approval.

Whether you prefer traditional bank loans or virtual loans, Lendingpot can help you quickly find the most suitable loan plan. Click “Apply Now” and start your loan journey!

Click now”Apply Now”, or make an appointment to communicate with our advisory team to start your exclusive loan journey!

Lendingpot is working on making your search for financial products an easy one. Apply on our platform for personal loans, business loans and mortgage refinancing to get access to exclusive rates with our partners. On top of that, we aim to bring you insights & reviews on the latest financial products available.